virginia estate tax exemption

It went into effect on January 1 2011. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

How To Reduce Virginia Income Tax

This type of exemption is often referred to as a wildcard exemption.

. Property Exempted by Local Classification or Designation on or After January 1 2003 581-3651. With his signature. Texas veterans with VA disability ratings between 10 and 100 may qualify for property tax exemptions starting at 5000 for 10-29 disability and ending at a full exemption for those VA-rated as 100 disabled.

Be totally or permanently disabled. Up to 25 cash back The Virginia homestead exemption also allows individuals to deduct an additional 5000 in real or personal property including cash or 10000 if the debtor is 65 years of age or older. There are certain requirements they must meet to qualify for the tax relief programs.

Federal Estate Tax. Property exempt from taxation by classification or designation by ordinance adopted by local governing body on or after January 1 2003. Tax Exempt Property Read Chapter.

The exemption is portable meaning that one spouse can pass their exemption to the other. Use the map below to find your city or countys website to look up rates due dates. The exemption extends to the surviving spouse if the veterans death occurred on or after January 1 2011.

With the elimination of the federal credit the Virginia estate tax was effectively repealed. A local assessors office is in charge of determining the assessed value which is then multiplied by the property tax rate resulting in the amount on your. An exemption may be claimed for each dependent claimed on your.

The exemption doesnt apply to property purchased by the Commonwealth of Virginia then transferred to a private business. Pursuant to subdivision a of Section 6-A of. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

There is a federal estate tax and many states levy their own estate taxes. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. Typically when an estate planning attorney in Virginia is reviewing an estate plan or a clients options for an estate plan they will review it with estate plan tax exposure in mind.

Glenn Youngkin signed a bill into law today that creates a property tax exemption for residential and mixed-use solar energy systems up to 25 kilowatts. Virginia currently does not have an independent estate tax that is lower than the federal exemption. Those over the age of 65 may also qualify for additional property tax exemption programs.

However certain remainder interests are still subject to the inheritance tax. An Application for Exemption from Real Estate Taxation form is available on the tax forms page. Disability of Veteran must be 100 service.

SB 686 expands energy freedom for consumers and creates an additional incentive to do business in the Commonwealth. Commissioner of the Revenue Taxpayer Assistance. Senior and Disabled Real Estate Tax Relief.

See the Virginia Estate and Inheritance Taxes. Commissioner of the Revenue Taxpayer Assistance. Localities may also impose a local probate tax equal to 13 of the state probate tax.

See the Code of Virginia Title 581 Chapter 36 for a list of exempt property classes and a list of exempt organizations corporations and associations. Today Virginia no longer has an estate tax or inheritance tax. Own and reside in the property being taxed.

Other Exempt Property Solar Energy Equipment Tax Exemption. Virginia allows an exemption of 930 for each of the following. By Kelsey Misbrener April 12 2022.

Virginia Estate Tax. Table of Contents Title 581. Exemption from taxes on property for disabled veterans.

Tax Exempt Property Article 41. Pursuant to subdivision a of Section 6-A of Article X of the Constitution of Virginia and for tax years beginning on or after January 1 2011 the General Assembly hereby exempts from taxation the real property including the joint real property of married. Senior citizens and totally disabled persons have the right to apply for an exemption deferral or reduction of property taxes in Virginia.

Virginia General Assembly legislation exempts from real estate tax the principal residence of disabled veterans those whose disability is 100 percent service-connected permanent and total. Each filer is allowed one personal exemption. The federal estate tax exemption is 1170 million for 2021 and will increase to 1206 million for deaths in 2022.

Property exempt from taxation by classification. Download Or Email Form VA-4 More Fillable Forms Register and Subscribe Now. Exemptions Generally Read all 581-3600 Definitions 581-3601 Property becomes taxable immediately upon sale by tax-exempt owner 581-3602 Exemptions not applicable to associations etc paying death etc benefits 581-3603 Exemptions not applicable when building is source.

Be 65 or older. When using the Spouse Tax Adjustment each spouse must claim his or her own personal exemption. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381.

The assessed value of your home is the basis of your property tax in Virginia. Property tax exemption for certain veterans. Click here for information and forms relating to the program or call the Commissioner of the Revenue Real Estate Qualification Division at 757 385-4385 for details.

For example the tax on an estate valued at 15500 is 1550. Pursuant to the authority granted in Article X Section 6 a 6 of the Constitution of Virginia to exempt property from taxation by classification the following classes of real and personal property shall be exempt from taxation. Bateman Advanced Shipbuilding and Carrier Integration Center then transferred to a qualified shipbuilder is exempt from sales tax.

As used in this chapter unless the context clearly shows otherwise the term or phrase. West Virginia wont tax your estate but the federal government may if your estate has sufficient assets. If you have questions about personal property tax or real estate tax contact your local tax office.

Real Property Tax Exemptions for Veterans On November 2 2010 by the citizens of the Commonwealth of Virginia ratified a proposed amendment adding Section 6-A to the Constitution of Virginia. However property acquired by the Herbert H. Tax rates differ depending on where you live.

So youll have 25000 you can use to protect your home plus an additional 5000. The average property tax rate in Virginia is 080 which is lower than the national average of 107. Local Taxes Chapter 36.

Decedent means a deceased person. Ad From Fisher Investments 40 years managing money and helping thousands of families. For Virginians who died prior to mid-2007 Virginias state estate taxes began at about 8 percent on estates over 2 million and rose to about 16 percent for estates over 10 million.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. For married couples each spouse is entitled to an exemption.

Taxation Subtitle III. The federal estate tax exemption is 5450000 for.

How To Reduce Virginia Income Tax

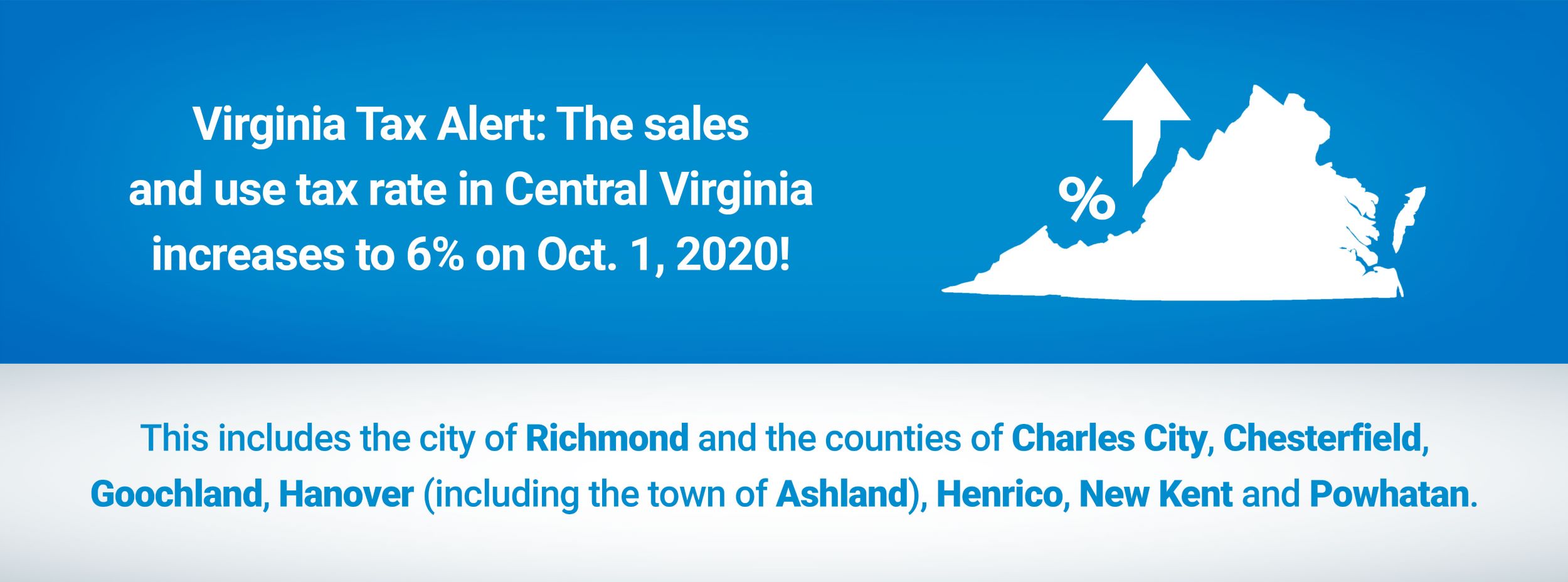

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Selling Inherited Property In Virginia 2022 How To Guide

How To Avoid Probate In Virginia

West Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Estate Tax Everything You Need To Know Smartasset

Virginia State Taxes 2022 Tax Season Forbes Advisor

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax

Virginia Retirement Tax Friendliness Smartasset

Estate Taxes They Re Not Dead Yet C Douglas Welty Plc

Virginia Estate Tax Everything You Need To Know Smartasset

Estate And Trust Tax Kwc Alexandria Virginia Accounting

States With No Estate Tax Or Inheritance Tax Plan Where You Die

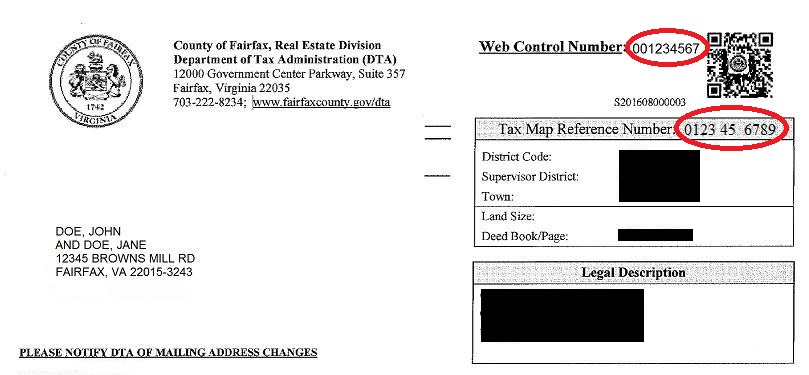

Real Estate Tax Frequently Asked Questions Tax Administration

West Virginia Estate Tax Everything You Need To Know Smartasset

Tax Tip Have Virginia State Tax Questions Virginia Tax

West Virginia Estate Tax Everything You Need To Know Smartasset